How to Get My Car Title: A Complete Guide to Obtaining Your Vehicle Title

How to Get My Car Title: Step-by-Step Guide to Vehicle Title Retrieval

Learn how to get your car title quickly and easily, whether from a lienholder or by applying for a duplicate. Avoid DMV hassle with expert tips.

Introduction

If you’re wondering how to get my car title, you’re not alone. Whether you’ve just paid off your vehicle loan, lost your original title, or bought a car without a title, understanding the process can save you time, money, and frustration. At J.G. Title Company, we specialize in simplifying vehicle title and registration services nationwide, helping drivers avoid long DMV lines and confusing paperwork.

This guide will walk you through everything you need to know about obtaining your car title—from getting it from a lienholder after paying off your loan to applying for a duplicate title if yours is lost. We’ll also cover state-specific nuances, common challenges, and how our mostly online platform can streamline the entire process for you.

What Is a Car Title and Why Is It Important?

A car title is an official document issued by your state’s Department of Motor Vehicles (DMV) that proves ownership of your vehicle. It includes vital information such as:

Vehicle identification number (VIN)

Owner’s name and address

Lienholder information (if applicable)

Vehicle make, model, and year

Without a valid title, you cannot legally sell, transfer, or register your vehicle. It’s essential to have your title in hand once your car loan is paid off or when you purchase a vehicle.

How to Get My Car Title After Paying Off a Loan

If you financed your vehicle, your lender (lienholder) holds the title until you pay off the loan in full. Here’s how to get your title once your loan is paid:

Step 1: Confirm Loan Payoff

Make sure your loan is fully paid. Request a payoff statement from your lender if needed.

Step 2: Lien Release

The lender will send you a lien release document or electronically notify the DMV that the lien has been satisfied.

Step 3: Obtain the Title

If the lender holds the paper title: They will mail the title to you or directly to the DMV for reissuance without the lien.

If your state uses electronic titles: The DMV will issue a new title in your name without the lienholder.

Step 4: Register Your Vehicle (if needed)

Once you have the clear title, update your registration if required by your state.

Tip: Some states allow you to request the title online or through a third-party service like J.G. Title Company, which can handle the paperwork and save you DMV trips.

How to Get a Duplicate Title if You Lost Yours

Losing your car title can be stressful, but getting a duplicate is straightforward if you follow these steps:

Step 1: Gather Required Information

You’ll typically need:

Vehicle identification number (VIN)

License plate number

Proof of identity (driver’s license or ID)

Vehicle registration

Step 2: Complete Your State’s Duplicate Title Application

Each state has a specific form (e.g., VSD 190 in Illinois). You can usually download it from your DMV website.

Step 3: Submit the Application and Pay Fees

Submit the form online, by mail, or in person along with the required fee. Fees vary by state.

Step 4: Wait for Processing

Processing times vary from a few days to several weeks depending on the state and method of application.

Pro Tip: Use J.G. Title Company’s online platform to expedite the process and avoid DMV lines. We handle the paperwork and follow up with the DMV on your behalf.

How to Get the Title if You Bought a Car Without One

Buying a car without a title can complicate ownership transfer, but it’s not impossible to get a title:

Step 1: Verify Vehicle Ownership

Check the vehicle’s VIN with your state DMV or a vehicle history report to ensure it’s not stolen or has outstanding liens.

Step 2: Obtain a Bill of Sale

Get a notarized bill of sale from the seller as proof of purchase.

Step 3: Apply for a Bonded Title or Title Through Affidavit

Bonded Title: Purchase a surety bond for the vehicle’s value if the title is lost or unavailable.

Title by Affidavit: Some states allow you to apply for a title by submitting an affidavit explaining the circumstances.

Step 4: Submit Application and Supporting Documents

Provide all required documents to your DMV or through a trusted service provider.

Step 5: Complete Vehicle Inspection (if required)

Some states require a vehicle inspection or VIN verification before issuing a title.

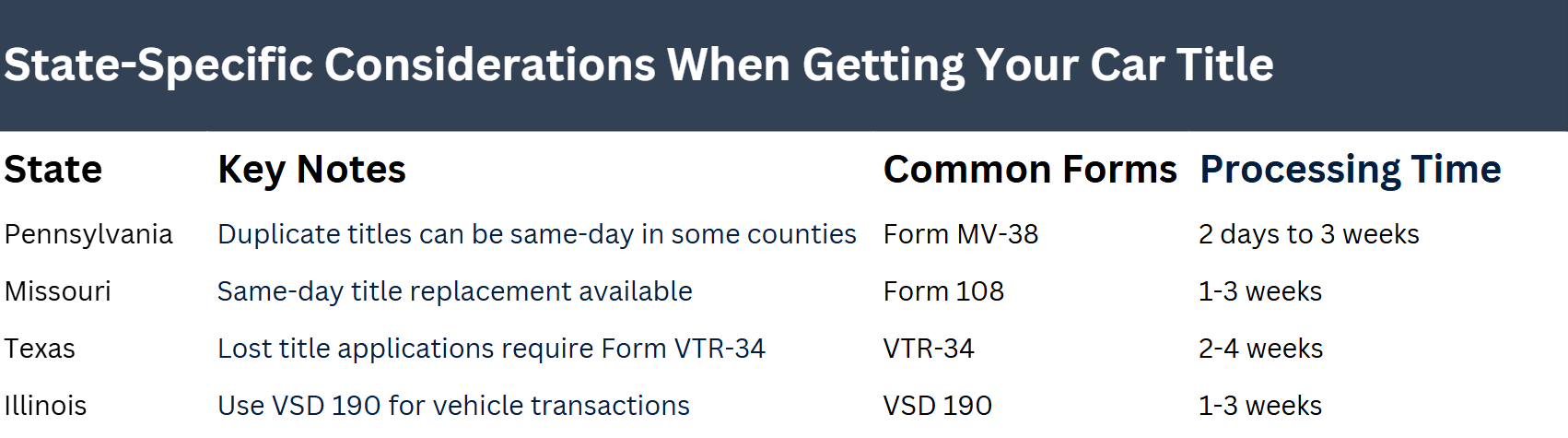

State-Specific Considerations When Getting Your Car Title

Each state has unique rules and forms for title issuance. Here are some examples:

Tip: Check your state DMV website or use J.G. Title Company’s platform for state-specific guidance and faster processing.

How J.G. Title Company Simplifies Getting Your Car Title

Our platform is designed to help drivers nationwide avoid the hassle of DMV visits by:

Providing mostly online title and registration services

Handling lien releases and duplicate title applications

Offering expert document auditing to ensure accuracy

Serving all 50 states and Tribal Lands with compliance and reliability

With J.G. Title Company, you save time, avoid confusion, and get your title faster.

Frequently Asked Questions (FAQs)

Q1: How long does it take to get my car title after paying off the loan?

A: It varies by state but typically ranges from 2 days to 3 weeks. Using a service like J.G. Title Company can speed this up.

Q2: Can I get a car title online?

A: Many states offer online applications for duplicate titles or lien releases. J.G. Title Company also provides an online platform to manage this process.

Q3: What if my lienholder never sent me the title?

A: Contact your lienholder to confirm payoff and request the title. If they fail to provide it, you may need to contact your DMV for assistance.

Q4: Is a notarized bill of sale required to get a title?

A: Requirements vary by state. Some states require notarization; others do not. Always check your local DMV rules.

Q5: Can I register a car without a title?

A: Generally, no. However, some states allow registration with a bonded title or affidavit if the title is missing.

Conclusion

Knowing how to get my car title is essential for every vehicle owner. Whether you’re retrieving it from a lienholder after paying off your loan, applying for a duplicate, or securing a title for a car bought without one, understanding the process can save you time and stress. J.G. Title Company’s streamlined, mostly online platform is here to help you navigate these steps efficiently and compliantly—no more long DMV waits or confusing paperwork.

Ready to get your car title hassle-free? Visit J.G. Title Company today and let our experts handle the rest.