Lien Release Letter: What It Is and How to Obtain One for Your Vehicle

Lien Release Letter: How to Obtain and Use It for Vehicle Title & Registration

Learn what a lien release letter is, how to get one, and why it’s essential for vehicle title and registration. Simplify your DMV process with expert tips.

What Is a Lien Release Letter? A Complete Guide

When you pay off a vehicle loan, the lienholder (usually a bank or financial institution) must officially release their claim on your vehicle. This release is documented through a lien release letter—a critical document that proves you fully own your vehicle free and clear of any liens.

Without this letter, you cannot transfer the vehicle title into your name or register the vehicle without restrictions. Understanding the lien release letter, how to obtain it, and how it fits into the vehicle titling and registration process can save you time, confusion, and costly delays.

In this guide, we’ll walk you through everything you need to know about lien release letters, including traditional DMV processes and how J.G. Title Company’s streamlined online platform can simplify the entire experience.

Why Is a Lien Release Letter Important?

A lien release letter serves as official proof that the lienholder has relinquished their legal claim on your vehicle. This document is essential for:

Title Transfer: To transfer the vehicle title into your name, the DMV requires proof that the lien has been released.

Vehicle Registration: Registering your vehicle without a lien release can be impossible or delayed.

Selling Your Vehicle: Buyers want assurance that the vehicle is free of liens.

Legal Ownership: It protects your rights as the sole owner of the vehicle.

Without a lien release letter, your vehicle remains encumbered, meaning the lienholder still has a legal interest in it.

How to Obtain a Lien Release Letter: Step-by-Step

Obtaining a lien release letter can vary by state and lienholder, but the general process involves the following steps:

1. Confirm Loan Payoff

Ensure your loan is fully paid off.

Request a payoff statement from your lender showing the balance is zero.

2. Request the Lien Release Letter

Contact your lienholder directly (bank, credit union, or finance company).

Ask for a lien release letter or lien release document.

Some states issue a lien release form or certificate of lien release instead.

3. Receive and Verify the Document

The lien release letter should include:

Vehicle identification details (VIN, make, model)

Lienholder’s name and contact information

Statement confirming lien release

Date of release and authorized signature

4. Submit to Your DMV or Title Agency

Present the lien release letter when applying for a new title or title transfer.

Some states require the original document; others accept certified copies.

5. Complete Title Transfer and Registration

Once the lien release is verified, the DMV will issue a clear title in your name.

You can then register your vehicle without restrictions.

Common Challenges in Obtaining a Lien Release Letter

Delayed Processing: Lienholders may take days or weeks to send the release.

Lost or Misplaced Documents: Paperwork can get lost in transit.

State-Specific Requirements: Each state has unique forms and submission rules.

Out-of-State Lienholders: Coordination can be complicated if the lienholder is in a different state.

How J.G. Title Company Simplifies the Lien Release Process

At J.G. Title Company, we understand the frustration of long DMV lines, confusing paperwork, and waiting for lien releases. Our technology-driven platform offers an online service that handles lien release letters and title transfers for you.

Benefits of Using J.G. Title Company:

Expert Handling: Our trained staff manages the entire lien release and title process.

Nationwide Coverage: We operate across all 50 states and Tribal Lands.

Time Efficiency: Avoid DMV wait times and paperwork errors.

Compliance & Accuracy: We ensure all documents meet state-specific requirements.

Transparent Tracking: Stay updated on your lien release and title status.

By choosing J.G. Title Company, you gain peace of mind knowing your lien release letter and title transfer are handled professionally and efficiently.

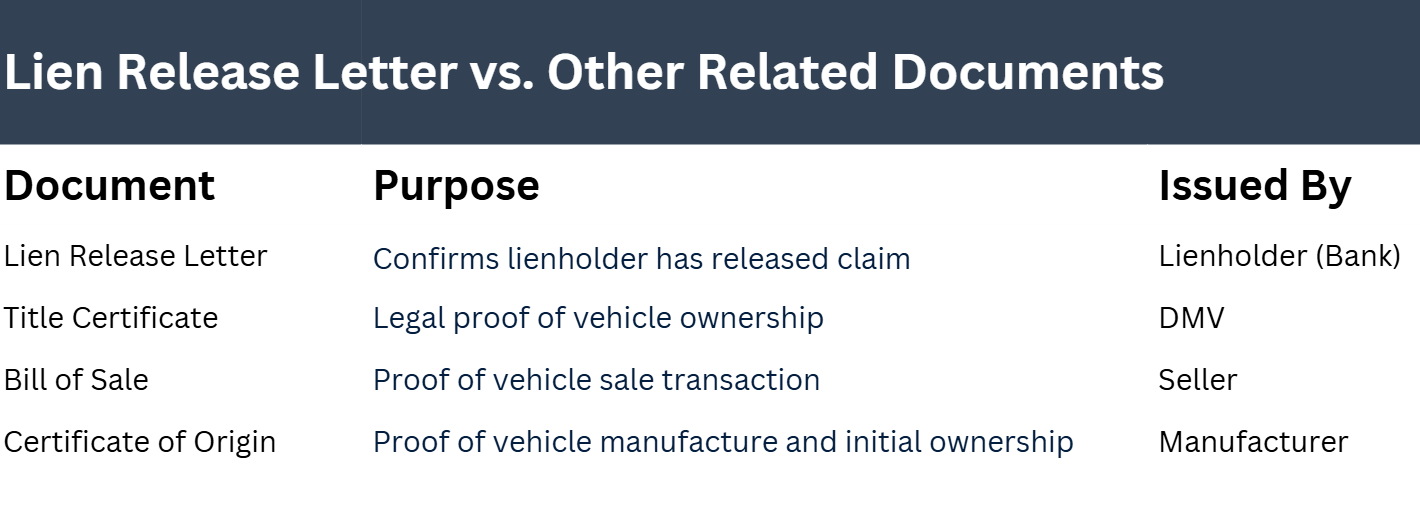

Lien Release Letter vs. Other Related Documents

Understanding the difference between a lien release letter and other vehicle documents is important:

State-Specific Considerations for Lien Release Letters

Each state has its own DMV rules for lien releases and title transfers. Some states issue electronic lien releases, while others require physical letters or forms.

Examples:

Pennsylvania: Requires a lien release letter or form to clear the title.

Missouri: May accept electronic lien release but often requires a physical document for title transfer.

Texas: Has a specific lost title application process if the lien release letter is missing.

J.G. Title Company’s platform is designed to navigate these state-specific nuances, ensuring your lien release letter meets all local requirements.

FAQs About Lien Release Letters

1. How long does it take to get a lien release letter?

Processing times vary by lender and state but typically range from a few days to three weeks.

2. Can I get a lien release letter online?

Some lienholders offer electronic lien release letters. J.G. Title Company can assist in obtaining these digitally where available.

3. What if I lost my lien release letter?

You can request a duplicate from your lienholder or use J.G. Title Company’s services to help recover or replace the document.

4. Is a lien release letter the same as a title?

No. The lien release letter proves the lien is cleared; the title proves vehicle ownership.

5. Can I register my vehicle without a lien release letter?

Generally, no. Most DMVs require proof of lien release to register a vehicle free of liens.

Conclusion: Secure Your Lien Release Letter with Confidence

A lien release letter is a vital document that confirms your vehicle is free from financial claims and ready for title transfer and registration. Navigating the lien release process can be complex and time-consuming, especially with varying state requirements and lender procedures.

J.G. Title Company offers a reliable, technology-driven solution to simplify obtaining your lien release letter and completing your vehicle title and registration. Avoid the hassle of DMV visits and paperwork confusion—let our experts handle it for you.

Ready to get your lien release letter and clear title hassle-free? Contact J.G. Title Company today and experience the streamlined way to manage your vehicle documents!